Table of Contents

- Key Takeaways

- UK Fire Safety Statistics 2024: The HMO Challenge

- HMO Fire Risk Assessment Cost Calculator

- What is HMO Fire Risk Assessment?

- Legal Requirements for HMO Fire Safety

- Professional HMO Assessment Process

- Essential Fire Safety Measures for HMOs

- Get Your Professional HMO Assessment Quote

- Frequently Asked Questions

Key Takeaways

| Aspect | Details |

|---|---|

| Legal Requirement | Mandatory under Regulatory Reform (Fire Safety) Order 2005 & Fire Safety Act 2021 |

| Assessment Cost | £300-£800 depending on property size and complexity |

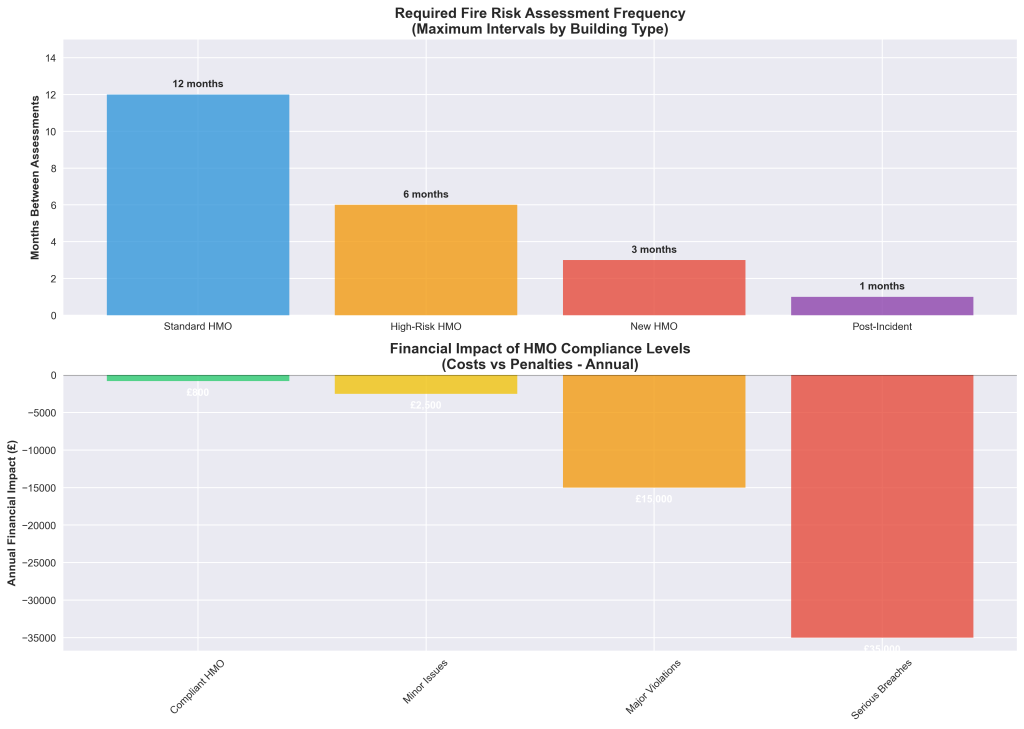

| Frequency | Annual reviews recommended, after any structural changes |

| Professional Benefits | Expert hazard identification, legal compliance, insurance protection |

| Key Safety Measures | Fire doors, smoke alarms, emergency lighting, clear escape routes |

| Licensing Impact | Required for HMO license approval and renewal |

| 2024 UK Fire Data | 136,702 total fires attended, 25% compliance rate for fire doors |

| HMO Fire Risk | 87% of HMO fires start in kitchens, 75% of fire doors fail inspections |

UK Fire Safety Statistics 2024: The HMO Challenge

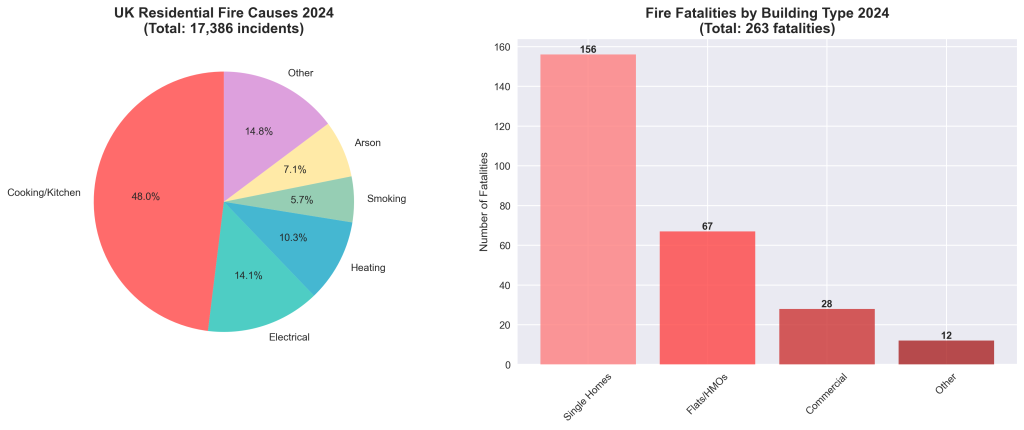

Critical Data Points:

- Total UK fires in 2024: 136,702 incidents (3.9% decrease from 2023)

- Kitchen fires from cooking: 6,609 incidents with 958 casualties

- Fire door compliance: Only 25% pass inspections

- Fire-related fatalities: 263 deaths in England

Why HMOs Are High-Risk Properties

Research shows that HMOs face disproportionate fire risks compared to single-family homes:

Kitchen Fire Concentration:

- 87% of HMO fires originate in kitchens

- Multiple tenants sharing cooking facilities increases risk exponentially

- Unattended cooking incidents rise with occupancy density

- 6,609 cooker/oven fires recorded nationally in 2024

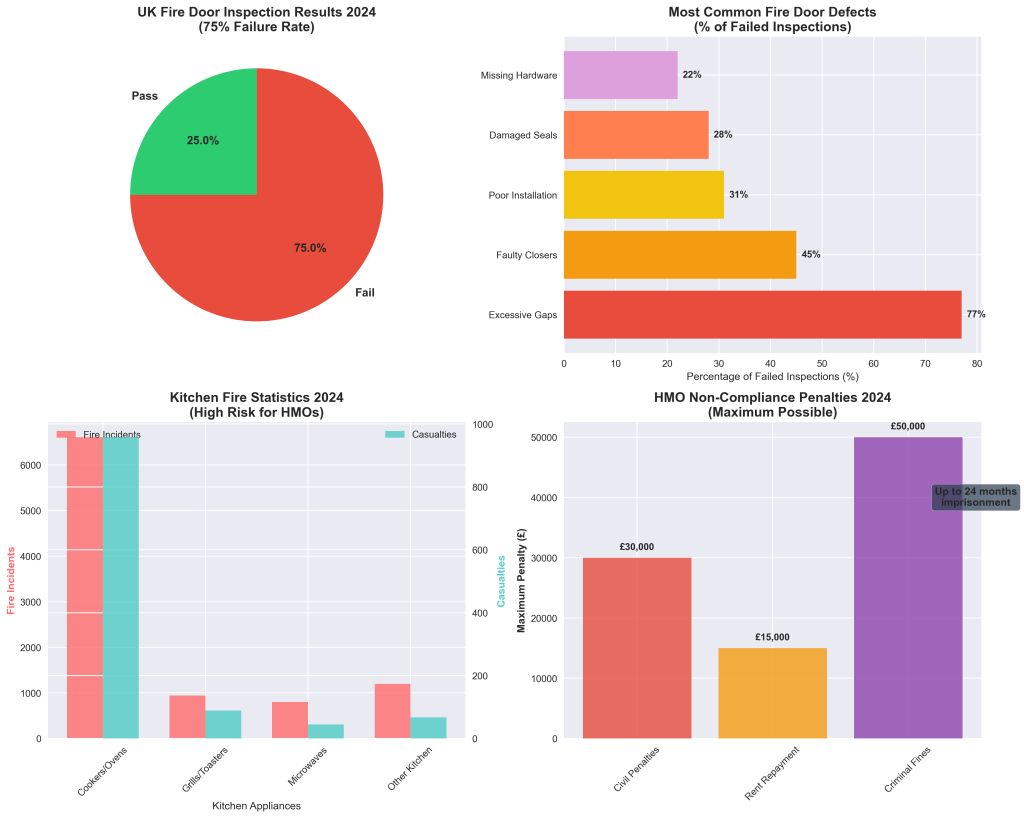

Fire Door Crisis:

- 75% of fire doors fail compliance inspections

- Excessive gaps found in 77% of failed doors

- Poor installation accounts for 31% of failures

- Self-closing mechanisms fail in 45% of inspections

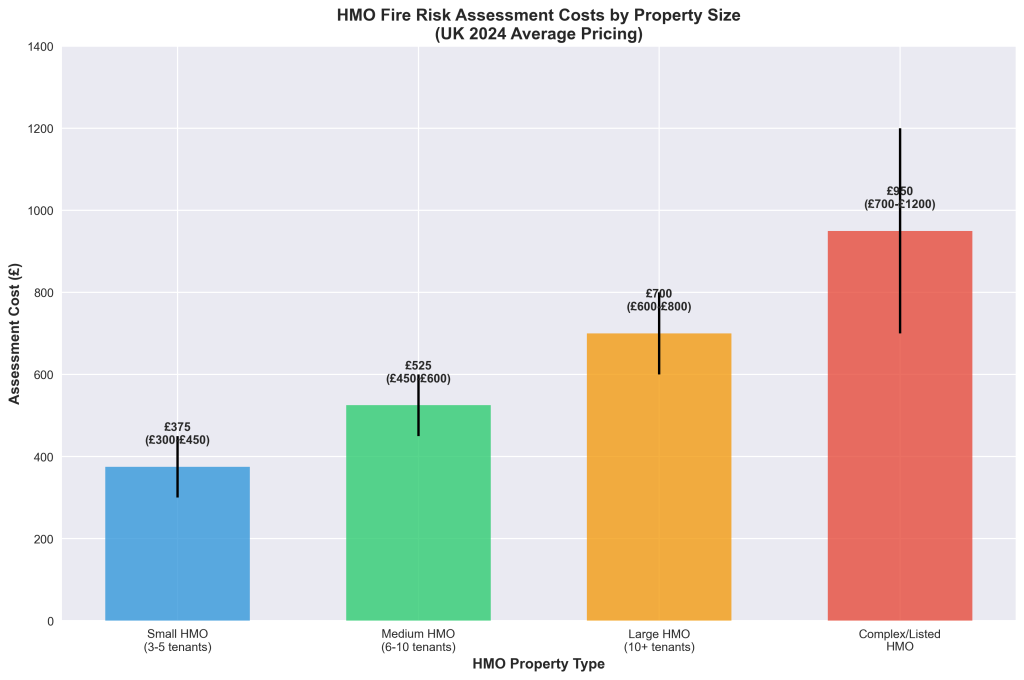

HMO Fire Risk Assessment Cost Calculator

Get instant pricing for your HMO fire risk assessment: Use our cost calculator

| Property Type | Typical Size | Assessment Cost | What’s Included |

|---|---|---|---|

| Small HMO (3-5 tenants) | 150-250m² | £300-£450 | Basic assessment, report, recommendations |

| Medium HMO (6-10 tenants) | 250-400m² | £450-£600 | Detailed assessment, emergency plans, compliance check |

| Large HMO (10+ tenants) | 400m²+ | £600-£800+ | Comprehensive assessment, multiple visits, full documentation |

| Complex/Listed HMO | Any size | £700-£1,200+ | Specialist assessment, heritage considerations, detailed planning |

Prices include professional assessment, detailed report, and 12-month support

Cost-Benefit Analysis:

- Average assessment cost: £525 (medium HMO)

- Average penalty for non-compliance: £15,000-£30,000

- ROI of compliance: 2,857% savings vs penalties

What is HMO Fire Risk Assessment?

A House in Multiple Occupation (HMO) fire risk assessment is a comprehensive evaluation of fire hazards and safety measures specifically designed for properties where three or more unrelated tenants share facilities. Unlike a standard fire risk assessment, HMO assessments require specialized expertise due to the unique risks associated with multiple occupants, shared cooking facilities, and complex escape routes.

Why HMOs Require Specialized Assessments

HMOs present distinct fire safety challenges:

- Higher occupancy density increases evacuation complexity

- Shared cooking facilities create concentrated fire risks

- Multiple electrical systems from different tenants

- Varied tenant awareness of fire safety procedures

- Complex building layouts can complicate escape routes

Types of Properties Requiring HMO Assessment

- Purpose-built flats with shared common areas (may also require fire risk assessment for flats)

- Converted houses split into multiple bedrooms

- Student accommodations and bedsits

- Boarding houses and hostels

- Holiday let properties with multiple guests

- Shared houses with communal facilities

Legal Requirements for HMO Fire Safety

Regulatory Reform (Fire Safety) Order 2005

Under this legislation, landlords and managing agents are legally required to conduct fire risk assessments for all HMO properties. Understanding who is responsible for fire risk assessments is crucial, as the “responsible person” must:

- Conduct regular fire risk assessments

- Implement fire safety measures

- Maintain fire safety equipment

- Provide fire safety information to tenants

- Keep detailed records of assessments and actions

Fire Safety Act 2021 Updates

Recent updates specifically address:

- Flat entrance doors must be included in assessments (see our guide on fire door regulations)

- Building structure and external walls require evaluation

- Enhanced responsibilities for building owners

- Stricter penalties for non-compliance

HMO Licensing Requirements

Most councils require valid fire risk assessment certificates before issuing HMO licenses:

- Mandatory licensing for properties with 5+ tenants

- Additional licensing schemes in many areas

- Selective licensing for specific property types

Non-Compliance Penalties: The Real Costs

2024 Penalty Statistics:

- Maximum civil penalties: £30,000 per breach

- Rent repayment orders: Up to 12 months’ rent

- Criminal fines: Unlimited for serious offences

- Imprisonment: Up to 2 years for responsible persons

- Building closure orders: Immediate for dangerous properties

Real-World Financial Impact:

- Compliant HMO annual costs: £800 (assessment + minor maintenance)

- Non-compliant penalties: £15,000-£35,000 average

- Insurance premium increases: 200-400% for non-compliant properties

- Loss of rental income: 3-12 months during remedial works

Professional HMO Assessment Process

Step 1: Initial Property Survey

Our certified assessors conduct comprehensive site inspections:

- Building structure evaluation

- Occupancy assessment

- Existing fire safety measures review

- Hazard identification

- Escape route analysis

Step 2: Risk Evaluation & Classification

We assess each identified hazard using industry-standard criteria:

| Risk Level | Classification | Action Required |

|---|---|---|

| Low Risk | Minimal likelihood/impact | Monitoring and maintenance |

| Medium Risk | Moderate concerns | Targeted improvements needed |

| High Risk | Immediate danger | Urgent remedial action required |

Step 3: Detailed Reporting

Every assessment includes:

- Executive summary of key findings

- Detailed hazard register with photographic evidence

- Prioritized action plan with timescales

- Compliance checklist for licensing requirements

- Cost estimates for recommended improvements

Step 4: Implementation Support

We provide ongoing assistance with:

- Contractor recommendations for remedial works

- Progress monitoring and re-inspections

- Documentation updates after improvements

- Annual review scheduling

Essential Fire Safety Measures for HMOs

Detection Systems

Smoke Alarms:

- Grade D (mains-powered) required in all rooms and common areas

- Interconnected systems ensure whole-property alerting

- Monthly testing and annual professional servicing (see our guide on how often fire alarms should be tested)

Heat Detectors:

- Kitchen installations prevent false alarms from cooking

- Garage and storage areas where smoke alarms are unsuitable

- Learn more about proper smoke detector locations for optimal coverage

Fire Containment Measures

Fire Doors:

- FD30 rated doors minimum standard for HMOs

- Self-closing mechanisms must function correctly

- Intumescent strips and smoke seals essential

- Annual inspection required for compliance

Compartmentation:

- Fire-resistant construction between separate units

- Proper sealing of service penetrations

- Protected escape routes maintained throughout

Emergency Evacuation

Escape Routes:

- Multiple exit options where possible

- Clear and unobstructed pathways at all times

- Appropriate width for maximum occupancy

- Emergency lighting for power failure scenarios (see our emergency lighting regulations guide)

Escape Strategy:

- Simultaneous evacuation for most HMO properties (understand the 3 categories of evacuation)

- Stay Put strategy may apply in purpose-built blocks

- Clear signage and exit route marking (understand fire safety signs requirements)

Fire Fighting Equipment

Portable Equipment:

- Appropriate extinguisher types for different fire risks (see our complete guide to types of fire extinguishers)

- Strategic positioning near high-risk areas

- Annual maintenance and inspection required (learn about fire extinguisher regulations UK)

- Fire blankets in kitchen areas

Get Your Professional HMO Assessment Quote

Why Choose Our HMO Fire Risk Assessment Service?

20+ Years HMO Expertise

- Specialized in multi-occupancy properties

- Detailed understanding of HMO licensing requirements

- Proven track record with local councils nationwide

Comprehensive Service Package

- Professional site survey and risk assessment

- Detailed report with photographic evidence

- Prioritized action plan with cost estimates

- 12-month support and guidance included

Fast Professional Service

- Assessment booking within 48 hours

- On-site survey completed same week

- Reports delivered within 24 hours

- Emergency assessments available

Full Compliance Guarantee

- Reports accepted by all UK councils

- Meets all HMO licensing requirements

- Professional indemnity insurance

- Free re-assessment if requirements change

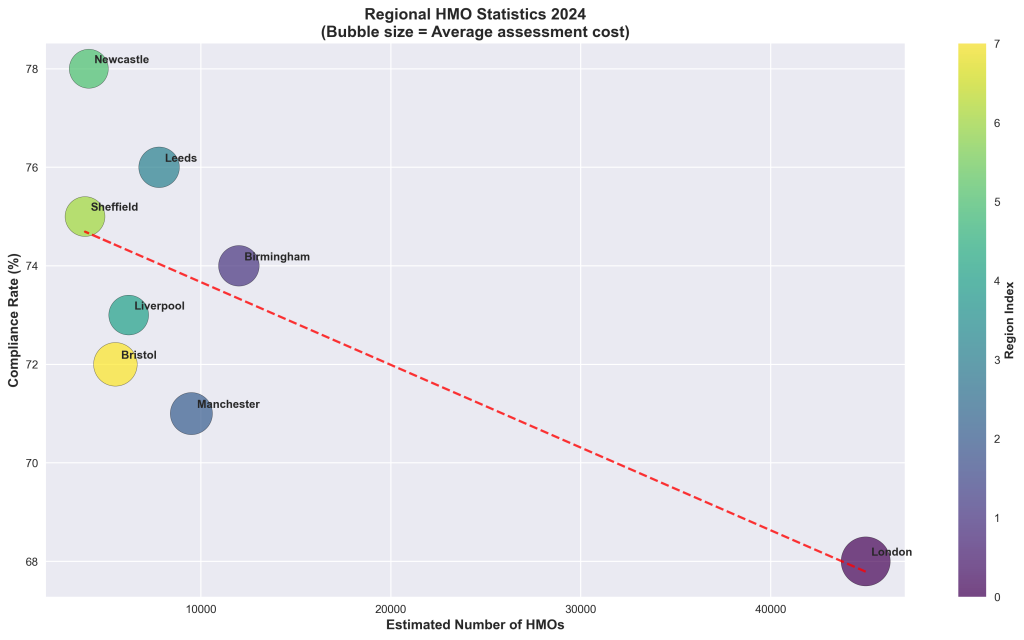

Service Coverage Areas & Regional Statistics

Our nationwide coverage includes:

| Region | Estimated HMOs | Compliance Rate | Avg Assessment Cost |

|---|---|---|---|

| London | 45,000+ | 68% | £950 |

| Birmingham | 12,000+ | 74% | £650 |

| Manchester | 9,500+ | 71% | £700 |

| Leeds | 7,800+ | 76% | £650 |

| Liverpool | 6,200+ | 73% | £625 |

| Newcastle | 4,100+ | 78% | £600 |

Regional Insights:

- London: Highest HMO density but lower compliance due to complex regulations

- Newcastle: Best compliance rates with streamlined council processes

- Urban areas: Generally higher assessment costs due to access challenges

- University cities: Seasonal assessment scheduling around the academic calendar

Get Your Professional Quote

Call: 0800 123 4567

Email: info@firerisk.io

Online: Book Assessment Now →

Emergency assessments available 24/7

Frequently Asked Questions

How much does an HMO fire risk assessment cost?

HMO fire risk assessments typically cost £300-£800, depending on:

- Property size and complexity

- Number of tenants and rooms

- Existing fire safety measures

- Location and accessibility

- Urgency of assessment required

For detailed pricing information, use our fire risk assessment cost calculator.

How often should HMO fire risk assessments be conducted?

Annual reviews are recommended as best practice, with immediate reassessment required after:

- Structural changes to the property

- Change in property use or occupancy

- Significant fire safety incidents

- Updated fire safety regulations

Can I conduct my own HMO fire risk assessment?

While legally possible, professional assessment is strongly recommended for HMOs because:

- Most councils require professional reports for licensing

- Complex regulations require specialist knowledge (see fire risk assessment steps)

- Insurance claims may be affected by assessment quality

- Professional indemnity protection is essential

Professional HMO fire risk assessments ensure building safety, regulatory compliance, and asset protection. Contact our certified team today for expert assessment and comprehensive support.